Small Business Development

Small Business Development: Empowering Entrepreneurs for Success

Small businesses are the backbone of our communities, driving economic growth, creating jobs, and fostering innovation. At our nonprofit, we are committed to supporting and strengthening these businesses by providing the resources, education, and connections they need to thrive.

What We Offer:

✅ Annual Business Conference – A premier event that brings together industry experts, successful entrepreneurs, and aspiring business owners. Attendees gain actionable strategies, expert insights, and networking opportunities to scale their businesses effectively.

✅ Small Business Cohorts – A dynamic, ongoing program where entrepreneurs receive hands-on training, mentorship, and peer support. Our cohorts focus on real-world challenges, providing solutions that help businesses grow sustainably.

✅ Access to Resources & Funding – Through our partnerships with financial institutions, business mentors, and economic development organizations, we help connect entrepreneurs with the capital and tools they need to expand their ventures.

By joining our Small Business Development Program, you’re not just gaining knowledge—you’re becoming part of a thriving network of business leaders who are shaping the future of their industries.

Take the next step in your business journey. Get involved today!

Social Media Posts/Videos

Meet Izhar Alvarez

Small Business Owner

In this short film we interview Izhar Alvarez, a Young Latino who started a Mobile Detailing Business at 24. He shares about his business, how he started and some tips and advice for someone wanting to start. Izhar was part of our IDEAL Wealth Academy, where he learned about credit, how to manage his finances better and create a plan to reach financial freedom.

PIZZA USA

Zen’s Tea House

Dulce Canella

The Buffalo Spot

Anna’s Pet Grooming

CHAMO FRUIT

Why is Financial Literacy Important For Small Businesses?

(Based on Stats)

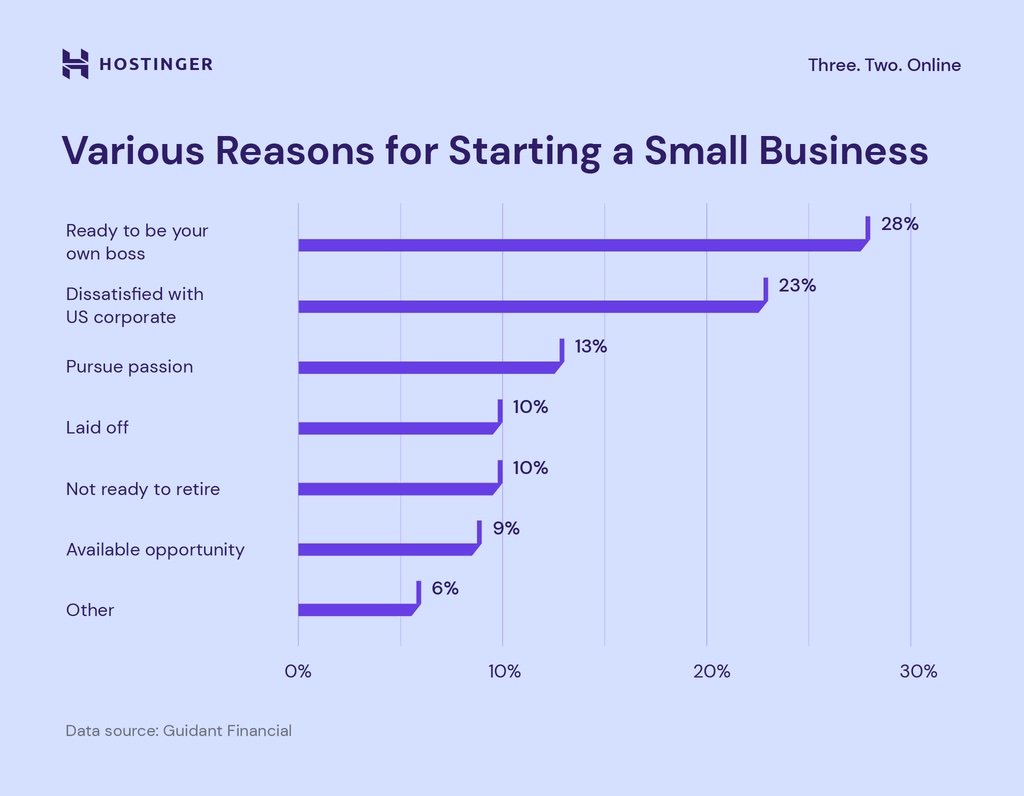

Hostinger reports that many people dream of starting a small business to be their own boss, pursue a passion, or create a flexible work schedule. However, the same report also highlights that around 20% of small businesses fail in their first year, and 50% don't make it past five years. Lack of financial literacy can be a major contributor to these failures.

At Avance Latino, we believe financial literacy is key to entrepreneurial success. That's why we provide our community with the tools and resources they need to make informed decisions and navigate the challenges of small business ownership. We empower our community to turn their dreams into reality by equipping them with the financial knowledge to increase their chances of success.